2024 Irs Tax Calendar – The latest annual inflation adjustments report from the Internal Revenue Service (IRS) reveals modifications to income tax brackets and standard deductions for the upcoming 2024-2025 tax season. . The IRS has announced new income tax brackets for 2024. In a press release, the IRS described the 2024 tax year adjustments that will apply to income tax returns filed in 2025. .

2024 Irs Tax Calendar

Source : carta.com

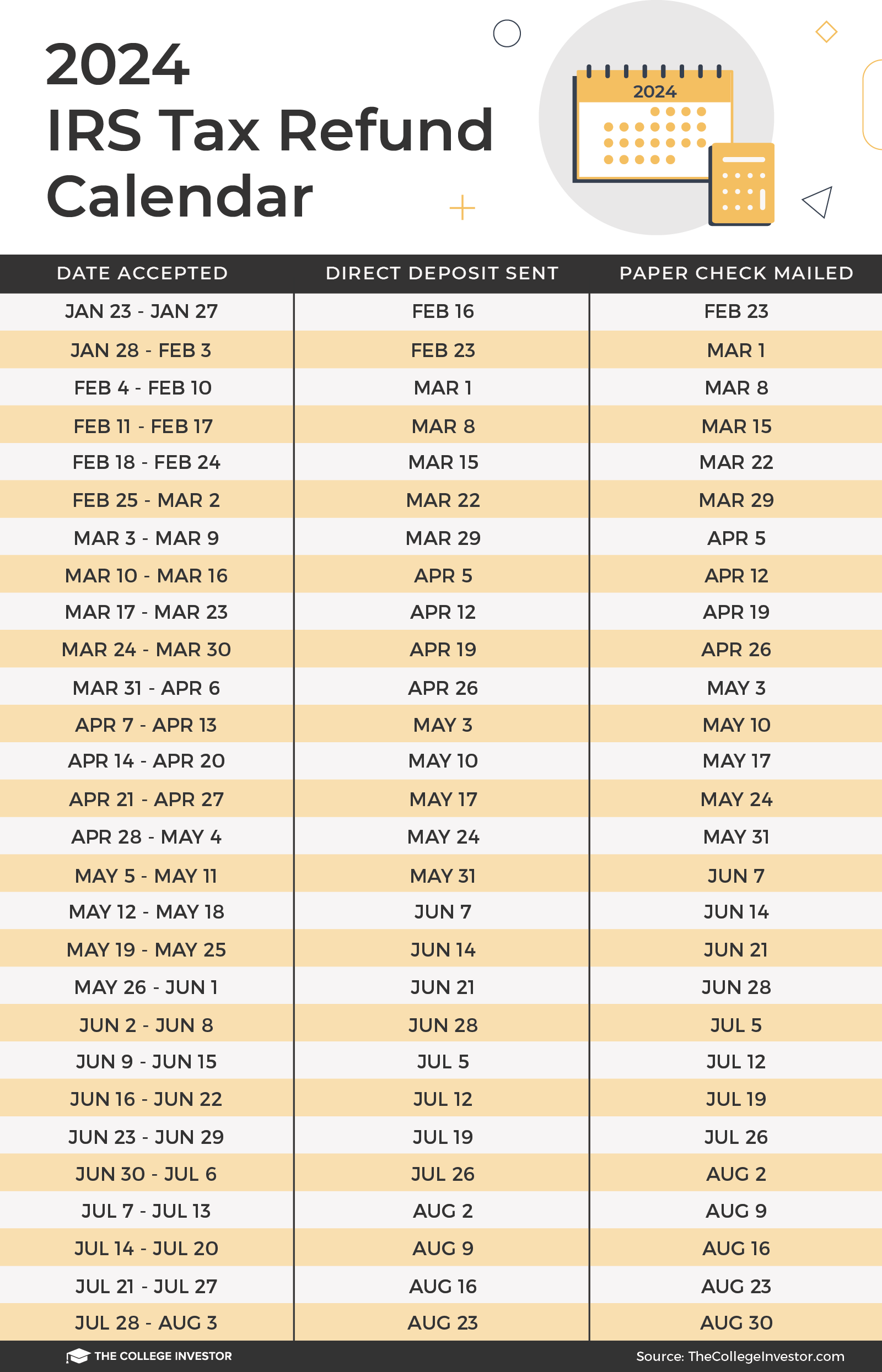

IRS Tax Refund Calendar 2024: Check expected date to get return

Source : ncblpc.org

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

IRS Refund Schedule 2024, Tax Return Calendar, e File & on Paper

Source : ncblpc.org

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

When To Expect My Tax Refund? The IRS Tax Refund Calendar 2024

Source : thecollegeinvestor.com

When To Expect My Tax Refund? The IRS Tax Refund Calendar 2024 : r

Source : www.reddit.com

IRS Schedule LEP Walkthrough (Request for Change in Language

Source : www.youtube.com

Tax Calculator: Return & Refund Estimator for 2023 2024 | H&R Block®

Source : www.hrblock.com

Tax Calculator: Return & Refund Estimator for 2023 2024 | H&R Block®

Source : advisors.vanguard.com

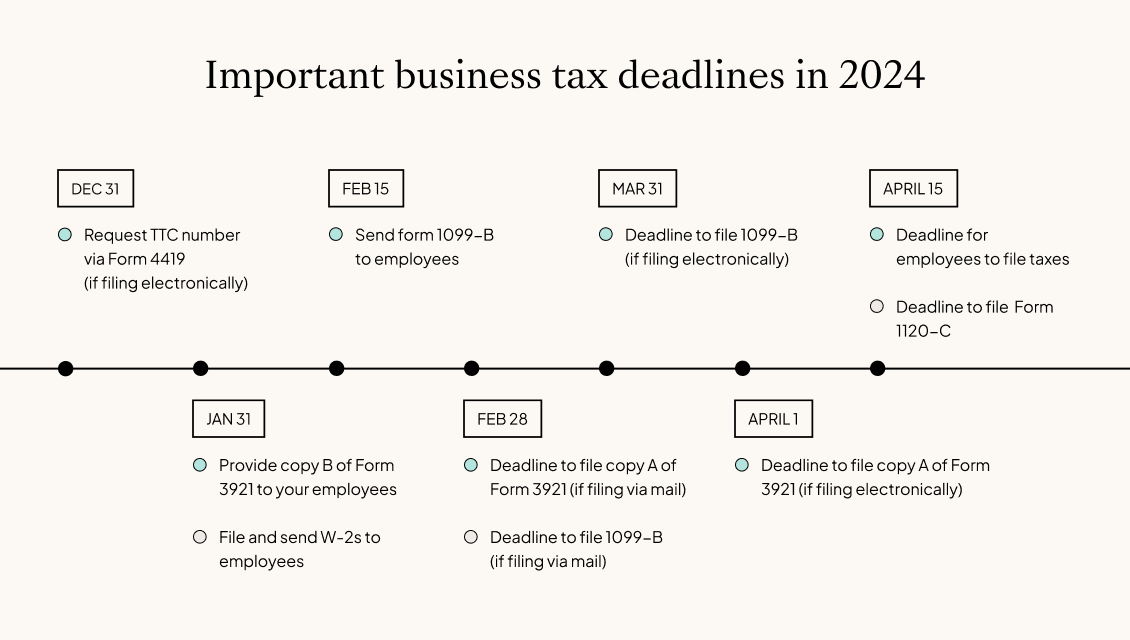

2024 Irs Tax Calendar Business tax deadlines 2024: Corporations and LLCs | Carta: The Internal Revenue Service announced on Thursday that the thresholds for income tax brackets, and the standard amount Americans can deduct, are both moving up. The moves — two among several . The tax year 2024 maximum Earned Income Tax Credit amount is $7,830 for qualifying taxpayers who have three or more qualifying children, an increase of from $7,430 for tax year 2023. The revenue .